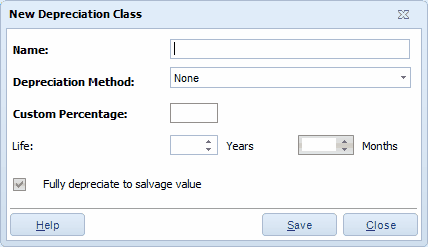

The Create New Depreciation Class screen allows you to specify what Depreciation Method, if any, should be used to calculate depreciation for an Asset Type associated with the Class, and for what period.

1.To access this screen, from the Main screen click New > Depreciation Class.

The Create New Depreciation Class screen can also be accessed from the Depreciation Class List by clicking the New Record button on the toolbar. For more information on using the List screens, see the Working with Lists topic.

2.Complete the fields on this screen. Name and Depreciation Method are required fields.

![]() It is a good idea to use a descriptive Class name that incorporates some indication of the depreciation method and the Years/Months you intend to specify for depreciation classes (with Depreciation Method other than None).

It is a good idea to use a descriptive Class name that incorporates some indication of the depreciation method and the Years/Months you intend to specify for depreciation classes (with Depreciation Method other than None).

Select the depreciation method you would like to use from the Depreciation Method drop down menu. Selecting None from the list specifies that depreciation is not to be calculated for Asset Types of this Class. Remember that these depreciation methods are selected on the Add/Edit Depreciation Class screen. Please refer to the topic Create New Depreciation Class or to the Definitions section for detailed definitions of each depreciation type.

Fully depreciate to salvage value option: If you select Double Declining, Custom or 150% Declining, the Fully depreciate to salvage value option will be enabled. Leave this checkbox selected (default) if you want Rosistem Assets to fully depreciate your assets to the salvage value.

Example: Assume you select double declining balance over five years, and enter a salvage value (entered on the Create New Asset screen) of 20.00 €. Assume that after 4 years, following the double declining balance method, the asset may have depreciated to 40.00 €. In this situation, if this checkbox is selected, Rosistem Assets will lower the value of the asset to the salvage value - 20.00 € in this case - at year 4 despite what the actual depreciated value is.

Uncheck this option if you do not want Rosistem Assets to fully depreciate the asset.

3.Click OK when you have completed the screen.

![]() If any method other than None has been selected, information must be entered in the Years and/or Months fields.

If any method other than None has been selected, information must be entered in the Years and/or Months fields.